Copper: compared with the previous big market, now go to what position?

Release time:2021-02-25Click:905

1.Summary

The recent rise in the price of copper has accelerated significantly and we believe that the following short-term factors are fermenting and contributing to the rise in the price of copper:

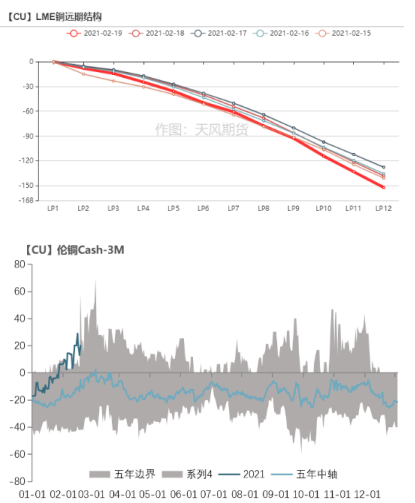

(1) Luntong has the characteristics of short-selling, while the price of copper rose sharply, the Cash-3M of Luntong soared all the way, combined with the low inventory of Luntong and the increase of the write-off warehouse receipt ratio, there is the characteristics of short-selling;

(2)The global inflation trade is on fire, with the 10-year treasury bond yield continuing to rise, soaring to 1.13 percent last week, and the interest rate market trading in recovery and inflation.

(3)Last week's overseas economic data continued to be strong, with both major PMI indicators in Europe and the United States, as well as U.S. sales of existing homes, more neutral and stronger than expected.

(4)Domestic copper inventory growth is weaker than seasonal, the market for post-holiday demand expectations higher, and according to our understanding, there are indeed some downstream orders have been placed to the second quarter;

(5)On the supply side, whether it is the release of new mine capacity or the volume of imported copper scrap, it still takes time to achieve, in other words, the current supply pressure is not reflected.

They and nearly 20 years of copper prices rose more than 50% of the market, respectively, 2003-2006,2007-2008,2009-2011 and 2016-2018, copper prices are now rising at a slower pace than in the wake of the financial crisis, roughly in line with the trajectory of 2003, and significantly stronger than the recent 2016 rally.

We don't think the 2016 and 2003 gains are comparable to the current gains, but the 2009 gains are more relevant. The main factors driving up copper prices in 2009 were global monetary easing, a weak dollar and strong traditional Chinese demand, while this round also unleashed huge amounts of liquidity overseas, but China's approach to liquidity has always been cautious, with traditional demand sectors less resilient than they were in 2009. Based on a number of factors, this may be a smaller increase than in 2009, but there is still considerable upside. After a quick rally in the short term, there is a need to guard against tighter central bank attitudes, possible short selling, and potentially negative expectations for overly optimistic demand at the moment.

2.Review of the short-term factors of last week

(1)There is the feature of Squeeze Bin in Luntong

During the last week's rally, the price curve of Luntong remained steep even though the near-end of the price curve had retrenched, while the price of Luntong Cash-3M remained firm and continued to rise in absolute terms, much stronger than the seasonal trend Taking into account the current low inventory and write-off warehouse receipts, the existence of Luntong short characteristics.

The LME's Futures Banding Report shows a high concentration of long and short positions in recent months; the Warrant Banding Report shows that one market participant holds 30-39 per cent of orders; Cash and Tom Reports also show a high concentration; All kinds of signs show that Luntong is in the pattern of squeezing position to a certain extent

(2)The inflation trade is lit

Treasury yields rose sharply last week, passing 1.13 per cent, before hitting 1.34 per cent on Friday. The advance of the vaccine, the new confirmed cases of the turn, so that the market saw the dawn of the epidemic. WITH $1,900 BN OF US INFRASTRUCTURE UNDER WAY and another $3,000 BN under way, the market's inflation trade is set ablaze.

(3)Key data from Europe and the US performed well last week

Last week was dominated by the manufacturing and services PMI for February in major European countries, the Markit manufacturing and services PMI for February in the US, and sales of existing homes in the US in January. The eurozone manufacturing PMI rebounded more than expected, but the services PMI continued to fall, mainly due to the impact on the services sector of continued stringent anti-epidemic policies in major European countries. The US Markit manufacturing sector slipped slightly, while the services sector index rose more than expected and remained broadly neutral. Sales of existing homes in the United States account for 70 to 80 percent of U.S. real estate sales. Sales of existing homes have maintained growth and slightly exceeded expectations. At present, U.S. real estate is still in a very good state and inventories are at very low levels, late continue to be optimistic about the U. S. real estate replenishment brought about by the related demand.

(4)After the festival, the domestic accumulation pool is slightly weaker than the seasonality

The magnitude of accumulated reserves for the Spring Festival in China is relatively weak compared with the seasonality. Under the background of the implementation of epidemic prevention policies in various places, some downstream enterprises appear to have a late holiday, return to work early (in previous years they did not return to work until after the Lantern Festival) , and even do not take a holiday, as a result, the inventory curve will be flattened this year, and the cumulative magnitude and length will probably be less than seasonal. The market for the domestic demand after the festival has a higher expectation, in fact, according to our telephone survey of some downstream enterprises, indeed there are enterprise orders very good. Global explicit inventories of refined copper (LME + COMEX + SHFE + bonded areas) remain at their lowest levels in recent years.

3.Compared with previous quotations, what is the current position of the copper price?

Compared with the historical experience, we have made a comparison with the prices of copper in the past 20 years, which have increased by more than 50% . They are 2003-2006,2007-2008,2009-2011 and 2016-2018, respectively, copper prices are now rising at a slower pace than they did after the financial crisis, roughly in line with the initial trajectory of the 2003 rally, and significantly stronger than the recent 2016 rally. We don't think the 2016 and 2003 gains are comparable to the current gains, but the 2009 gains are more relevant. The main factors driving up copper prices in 2009 were global monetary easing, a weak dollar and strong traditional Chinese demand, while this round also unleashed huge amounts of liquidity overseas, but China's approach to liquidity has been cautious, with traditional demand sectors less resilient than they were in 2009. For a variety of reasons, this may be smaller than the 2009 rally, but there is still plenty of room above. After a quick rally in the short term, there is a need to guard against tighter central bank attitudes, possible short selling, and potentially negative expectations for overly optimistic demand at the moment.

4.Other weekly fundamentals

1. Processing fees for copper concentrates

5. Output of major mining companies and news updates

In the fourth quarter of 2020, Aeris copper output was 0.89 million tons, unchanged from the previous quarter and up 19.6 percent from the previous year. The latest copper production target for fiscal year 2021 is 23,500-24,500 tonnes. In the fourth quarter of 2020, Evolution Mining's output was 0.545 m tonnes, down 1.8 per cent month on month and 2.2 per cent year on year. In the fourth quarter of 2020, Newmont's Boddington copper output was 0.6 million tons, unchanged from the previous quarter and down 21.1 percent from the same period a year earlier, mainly because Boddington's copper grade and ore handling remained at the same level as the previous quarter.

6.The structure of copper price difference in Shanghai

Last week, the Shanghai copper price curve moved up from its previous overall position. The contango structure near the curve was basically flat compared to last week. From the point of view of the premium discount, the premium in the copper spot market weakened last week, which is related to the rapid rise in absolute prices, and the accumulation of domestic inventory during the Chinese New Year holiday. However, in general, the scope and the time length of the accumulated reservoirs will probably be weaker than that of the same period in previous years, mainly because of the delay in transportation and logistics on the supply side due to the impact of epidemic prevention and control, as for the downstream demand, many places advocate on-the-spot lunar new year, so this year some downstream enterprises may have a late holiday, back to work early (usually only after the Lantern Festival) , or even no holiday. Therefore, this year's seasonal accumulation before the spring festival should be slightly lower than in previous years, and the entire inventory curve will be flattened. This also means that the price spread that would not have appeared until March or April in previous years will be stronger, and this year will appear ahead of schedule, therefore, we think that the layout of copper can be considered at present.

7.Changes in the ratio of Shanghai to Shanghai

Last week, the shanghai-shanghai parity moved upward in the center of gravity, after the opening of the Shanghai copper price quickly repair, and then continue to shock up. Previously we pointed out that the inside and outside comparison needs to consider the counter-cover in the short term, which was realized last week, but now the sustainability of the counter-cover is worth further observation, we think that the sustainability or there are some concerns. On the one hand, domestic demand has not fully recovered and released, the current structure of domestic price differentials is still contango, on the other hand, overseas inventories are currently at very low levels, and macro indicators show that their recovery momentum and replenishment momentum remain strong, and the curve is a steep BACK structure. From the perspective of import profit and loss, the current spot import loss is around 400 yuan. The loss range is not large, and the scope for rebound is relatively limited. Therefore, we believe that the following price comparison will still be relatively tangled, it is suggested that the transaction can be reduced. Of course, from the point of view of the pure profit of moving positions, it should be done in a proper way, but domestic short-sellers in the recent extreme market will bear the pressure of a larger margin.

8.Price difference between refined and waste products

The gap between refined and scrap prices widened sharply last week, mainly due to the rapid rise in the absolute price of copper. According to our telephone survey of some copper scrap production enterprises, the current supply of copper scrap is in short supply, demand is not bad. Domestic copper scrap in the last year experienced a sufficient inventory after the current supply of copper scrap is relatively tight. On the import of scrap copper, it may still be difficult to see a large-scale import replenishment in the short term, and overseas recycling, dismantling and logistics of scrap copper are still disturbing factors.

Source: Fengtian Futures Research Institute, by Wei Lai

Disclaimer: Some pictures and texts on this site are collected from the Internet and are only for learning and communication. The copyright belongs to the original author and does not represent the views of our site. This site will not bear any legal responsibility. If your rights are violated, please contact us to delete it in time.