Copper 2021 latest analysis: Rising inflation demand strong, the industry ushered in a strong double-click! It relates to clean power station, photovoltaic, wind power, energy storage field and new energy vehicle field

Release time:2021-02-20Click:1020

First, copper: take the fundamentals of strong macro positive wind

We expect that the copper price has entered a new round of rising cycle, there are two main drivers: 1) A demand-driven supply shortage pattern for electrolytic copper; 2) a weak dollar (in dollar terms) and the upward pressure of inflation on its financial properties to push up prices. We believe that the demand for 2021 copper will mainly come from: 1) overseas market: replenishment cycle plus restoration of demand after new Crown Disease Recedes; 2) in the global context of carbon neutrality, copper as a major raw material will benefit from new energy and electric vehicle acceleration; 3) domestic market demand growth remains stable. We believe that the 2021 copper price is expected to usher in commodity properties and financial properties of the "double-click" , to lay a solid foundation for a strong price. With the advent of carbon neutrality, copper demand will open up new space for growth. Compared with traditional power generation and automobile fuel, electric energy is the best intermediate carrier among all energy sources, and has obvious advantages in input, storage and output convenience and efficiency, while the input, storage and output of electricity can not bypass the most mature and cost-effective conductor material —— Foshan copper.

Second, the Global Clean Power Station enters the intensive construction period, the photovoltaic, the wind power, the energy storage domain uses the copper to be in the ascendant

As China's clean energy sector accelerates toward parity and aims to be carbon neutral by 2060, Europe ramps up its energy transformation policies to increase the share of renewable energy, and the U.S. Biden administration restores clean energy policies, we will strive to achieve zero net carbon emissions and other emission reduction targets by 2050. We expect the average annual new installed capacity of PV and wind power to be 71-94 gw and 13-26 gw, and the average annual copper demand to be 554-669,000 tons in 2021-2025, and the copper demand of PV and wind power to be 850,000 tons by 2030. Overseas countries are expected to add 103-114 gw of photovoltaic and wind power units annually from 2021 to 2025, and the average annual copper demand will range from 494.5 to 579,000 tons. The copper demand for photovoltaic and wind power generation is expected to be about 600,000 tons by 2030. In 2021-2025, global energy storage demand will drive copper by 5.31,8.22,11.12,14.03 and 180.9 tons respectively, CAGR is 36% . With the rapid development of the ternary battery energy storage market, the global copper demand is expected to reach 400,000 tons by 2030.

The era of global automotive electrification has come at an accelerated pace, with strong growth momentum in copper for new energy vehicles

China's new energy vehicle policy continues to lay a solid foundation for development, and the driving force of the automobile market is beginning to emerge. According to our calculation, the global sales of new energy vehicles in 2021-2025 are 4.65 million, 6.66 million, 8.9 million, 11.58 million and 14.45 million respectively, CAGR is as high as 38.3% , from 2021 to 2025, the amount of copper used in new energy vehicle and charging pile is 40,57,77,101 and 1.27 million tons respectively, CAGR is about 33.26% . Assuming a compound annual growth rate of 15% after 2025, the global sales of new energy vehicles are expected to reach 29.06 million by 2030, and the global consumption of new energy vehicles and charging posts is expected to reach 2.65 million tons of copper.

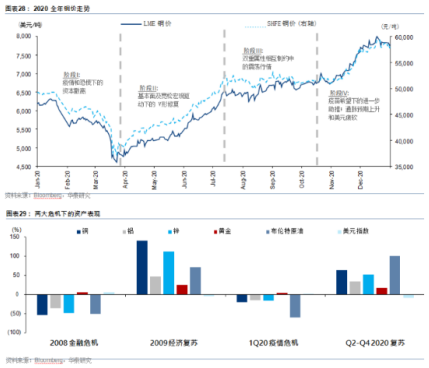

The 2020 Copper Price Roller Coaster: the dual drive of commodity attributes and financial attributes

In 2020, copper prices experienced a "roller coaster" , falling to a five-year low in late March and breaking through a seven-year high in December under the impact of the epidemic. The process fully reflects the dual nature of commodities and finance in its price, we look at the performance of copper prices in 2020 from both angles. Commodity attributes correspond to copper supply and demand fundamentals, while financial attributes reflect inflation expectations and the strength of the pricing currency, the dollar. We have divided 2020 into four phases: 1) Phase I, global capital market turmoil under the impact of the epidemic; 2) Phase II, fundamental-driven and macro-oriented recovery; 3) Phase III, range-based volatility under the constraints of dual attributes; and 4) Phase IV, where rising vaccine and inflation expectations drive up copper prices.

1. Phase I: epidemic impact, capital "flight" (january-march)

Following the Spring Festival outbreak in China, major consumer countries including Europe and the United States began to see new confirmed cases, global economic activity was hit the pause button, leading to a sudden halt in demand for copper downstream. At the same time, financial markets were Selling climax by concerns about liquidity risk, global asset classes fell sharply and the 10-year treasury bond rate and dollar index soared. Copper prices fell to a five-year low of $4,630 a tonne at the end of March under the double-click of commodity and financial attributes.

2. The second stage: Supply and demand improvement and macro-easing brought about a v-shaped recovery (april-mid-july) fundamentals: Demand Recovery, supply contraction

Into the 2Q20, with China's new crown disease largely under control, China has shifted its focus to economic restarting, supplemented by massive policy stimulus, they include increasing tax cuts and fee reductions to cut costs for businesses, raising the deficit rate, approving special government bonds and increasing the amount of special government debt. Copper demand rebounded quickly, with the monthly operating rate for Processing End Copper Rod companies up 34 percentage points to 83 per cent in April, while the monthly operating rate for downstream wire and cable companies rose 25 percentage points to 100.4 per cent. In addition, due to the impact of the epidemic, scrap copper from recycling to borrowing all links of the industrial chain are impacted, resulting in a shortage of copper scrap supply, driving the demand for refined copper replacement. Both factors contributed to a sharp drop in refined copper inventories, with total social inventories falling from a year-high of 867,000 tonnes in March to 371,000 tonnes at the end of June. On the supply side, major copper producers including Peru, Chile and Congo began to suffer disruptions from the outbreak in April. BHP announced a reduction in production at the CERROCOLORADO copper mine in Chile in early July; CODELCO suspended production at the Chuquicamata smelter and construction of its flagship Elteniente mine in late June; FirstQuantum suspended production at the COBREPANAMA mine in mid-april; The Mirador Mine at Ecuaduor reduced staff numbers to minimize operations.

3. Macro Environment: unprecedented macro loosening

The upturn in supply and demand coincided with an unprecedented easing of stimulus measures by the world's leading economies, led by the US, which led to a fall in the dollar, higher inflation expectations and stable nominal interest rates, pushing copper prices higher on the financial side. So far, the current round of copper prices rose more than 50% to 6,500 US dollars per ton, has broken the level before the epidemic.

4. The third stage: Interval fluctuation

On a fundamental level, while production disruptions in major regions have eased since 2H20, the prospect of supply from strikes in Chilean mines in the context of a new round of labour contract negotiations has raised concerns. On the demand side, the impact on the demand side (reflected in an increase in 3Q20 export orders from China) is small, although the second wave of new crown outbreaks has re-emerged in the US and Europe.

5. MACRO: US election brings uncertainty, new economic rescue plan suspended

Increased macro uncertainty, from: 1) the election is coming, the US is deeply polarised; 2) negotiations over a new economic rescue plan are on hold. Meanwhile, a second wave of new crown disease forced markets to reassess the progress of the global economic recovery, putting a pause in the upward trend in inflation expectations, while the strengthening of the euro prompted an accelerated decline in the dollar index in the context of Europe's $750 billion stimulus package. In such a period, macro and fundamental face-off situation, in the weak dollar, copper price shock slightly upward.

6. Stage 4: The vaccine is expected to be available and the U. S. election confirmed to further promote copper prices higher macro-good to promote copper prices higher

On the basis of stable supply and demand pattern, the financial attribute of copper dominates the upward trend of copper price in this stage. Despite global concern over a new coronavirus mutation in the UK, confidence in the efficacy of the vaccine remains. In addition, after the November election, negotiations on a new economic rescue plan resumed and a new $900 million plan was agreed in the last week of 2020. Macro factors pushed inflation expectations, represented by the 10-year US debt break-even ratio, up from 1.7 per cent in early November to 1.98 per cent at year-end, while the dollar index fell from 94 in November to 89.9 at year-end, pushing copper prices close to 8, $000/ton level.

Kill. The tight balance of supply and demand combined with the favorable macro environment has supported the high price movement of 2021 copper

We estimate that global copper demand will fall slightly by 1.3 per cent year-on-year in 2020, with 6.5 per cent year-on-year growth in China and a 9.4 per cent decline in markets outside China. Sentence is too long, please supply a shorter sentence.

At this point in time, we believe that copper prices have entered a new upward cycle, there are two main drivers: 1) A demand-driven supply shortage pattern for electrolytic copper; 2) a weak dollar (in dollar terms) and upward inflationary pressure pushing up the price of copper currency properties. We believe that the demand for 2021 copper will mainly come from: 1) the replenishment cycle of overseas markets and the repair of overseas demand after the new Crown Disease Recedes; 2) under the global carbon-neutral background, copper as the main raw material will benefit from the new energy and the Electric Vehicle Acceleration; 3) the growth of domestic copper demand will remain stable. Although supply will improve as new projects come on stream, existing projects ramp up and production normalizes after the outbreak, we expect a shortfall of 294,000 tonnes due to higher demand growth, 2021 said. We expect the 2021 to average $7,500 a tonne, up from $6,199 a tonne in 2020. On a sector by sector basis, we expect the auto sector to be the largest contributor to the growth in copper demand due to the recovery in conventional vehicles and the continued high growth in electric vehicle production and sales, said 2021, vice president of the automotive industry. We expect 2021's global auto industry to grow by 290,000 tonnes, or 17.4% , to 2.5 million tonnes, representing 28% of the increase in global copper consumption. For the new energy sector, which is mainly focused on wind and photovoltaic, we expect growth in copper consumption to be limited, given the potential slowdown in wind power installations in China, but to return to strong growth from 2022, said 2021, chief economist at HSBC. We expect copper consumption in the wind and photovoltaic sectors to grow 36,000 tonnes or 3 per cent year on year, with the Chinese market down 23 per cent year on year and markets outside China up 33 per cent year on year. On a regional basis, we believe that the main growth driver this year will shift from China (1.4 per cent year-on-year 2021 growth) to regions outside China (8.1 per cent year-on-year 2021 growth) . 8. We expect overseas markets to be in the early stages of an active replenishment cycle, driven by rising demand for raw materials from the manufacturing Capacity utilization, combined with a significant decline in overseas copper inventories due to massive exports to China in 2020. We are in the third month of a new replenishment cycle, according to U.S. manufacturing inventory data, and it usually takes 10 to 12 months for inventories to recover from a year ago bottom. Meanwhile, manufacturing in the Capacity utilization and Europe has been rising since the bottom of the 2Q20 and has yet to fully recover to pre epidemic levels. The US, eurozone and Germany produced 73.3 per cent, 78.1 per cent and 80.8 per cent of 4Q20, respectively, compared with 75.6 per cent, 81.2 per cent and 82.7 per cent of 4Q19 before the outbreak, and well below 4Q18's 77.4 per cent, 83.5 per cent and 87.1 per cent, respectively. We therefore believe that further restocking and a rebound in manufacturing Capacity utilization will continue to support demand for key raw materials, including copper. We expect copper consumption outside 2021 to grow 8.1 percent year on year to 11.5 million tons, with the automotive and new energy sectors the main contributors, with global carbon neutral driven increases of 19.9 percent and 33.4 percent, respectively.

Auto market will boost copper consumption 2021E by 2020, the global electric vehicle market and non-electric vehicle market performance differentiation. Despite the new crown, global electric vehicle sales remain strong, rising 15 per cent year-on-year to 5.1 m units in 2020. The most impressive growth was in Europe, where sales of electric cars totaled 1.1 million units, up 89 percent year on year, thanks largely to strong government policies: 1) super-car companies will face heavy fines; 2) countries are active in new energy subsidies. Total vehicle production in Europe fell 25.3 per cent year on year to 1.18 M in 2020, while electric vehicle sales rose 89 per cent to 1.1 m, with penetration climbing 6.7 percentage points to 10.7 per cent year on year by the end of 2020. Domestic Electric vehicle sales in 2020 dropped 35% year-on-year in 1H20, closing with high growth in 2020, achieving a cumulative increase of 10% to 1.37 million units.

For non-electric vehicles, Marklines'data show that sales of non-electric vehicles fell significantly in 2020, down 15 per cent year on year, dragging down the industry's overall copper consumption. We estimate that the auto industry's copper consumption in 2020 will fall by 261,000 tons or 10.7 percent to 2.17 million tons, with the consumption of electric vehicles increasing by 99,700 tons or 40.4 percent to 346,000 tons, copper consumption for non-electric vehicles fell 249,000 tonnes, or 14.3 per cent, to 1.49 m tonnes. We expect 2021's global vehicle production to increase by 15% year on year, 1) the non electric vehicle market is benefiting from a low base of 13% year on year growth; 2) the electric vehicle market will continue to grow by 45% year on year, and the penetration rate of electric vehicles is expected to increase from 6.5% in 2020 to 8.2% in 2021. We estimate that global automotive copper consumption will rise 371,000 tonnes, or 17.4 per cent, to 2.5 m tonnes in 2021 as a result of the recovery in conventional internal combustion vehicles and continued growth in electric vehicles. Specifically, by region, 81,000 tonnes of consumption growth came from the Chinese market and 290,000 tonnes from markets outside China. By category, 135,000 tonnes came from electric vehicles and 236,000 tonnes from non-electric vehicles. In the medium and long term, we believe that with the increase of electric vehicle penetration rate, even if the total vehicle production growth stagnates, the increase of copper consumption per bicycle can push the copper consumption of the auto industry from 2.1 million tons in 2020 to the level of 3 million tons (expected in 2025) , with a compound annual growth rate of 7.4% over five years. That figure does not include copper consumption in infrastructure development related to electric vehicles, including charging facilities, potential grid upgrades and expansion.

9. Global: The great era of global electrification has accelerated

In terms of overall global sales, nearly 400,000 vehicles were sold in November 2020, extending the October surge. Global sales of new energy vehicles in the first 11 months were 2.53 million units, up 30 percent year-on-year. Since August, the cumulative year-on-year sales have changed from negative to positive, and the upward trend is significant.

According to our calculation, the global sales of new energy vehicles in 2021-2025 are 4.65 million, 6.66 million, 8.9 million, 11.58 million and 14.45 million respectively, CAGR is as high as 38.3% , from 2021 to 2025, the amount of copper used in new energy vehicle and charging pile is 40,57,77,100 and 1.27 million tons respectively, CAGR is about 33.26% . Assuming a compound annual growth rate of 15% after 2025, the global sales of new energy vehicles are expected to reach 29.06 million by 2030, and the global consumption of new energy vehicles and charging posts is expected to reach 2.65 million tons of copper.

Since July 2020, the cumulative growth rate of copper demand has been faster than that of supply, and the gap between supply and demand has been widening. According to ICSG, global refined copper production was 2.15 million tons and consumption was 2.26 million tons in October 2020, resulting in a shortage of 113,000 tons in the global refined copper market in October. In the first 10 months of 2020, there was a shortage of 482,000 tonnes in the global refined copper market, compared with 354,000 tonnes a year earlier. From January to October 2020, the world's cumulative output of copper mines was 16.867 million tons, representing a cumulative year-on-year increase of-0.03 percent, and the global consumption of refined copper was 20.74 million tons, representing a cumulative year-on-year increase of 2.51 percent. Since July 2020, the cumulative demand for copper has been growing faster than the supply.

Production at the 2021 mine has recovered from the outbreak and new projects are beginning to come on stream. According to our calculations, we estimate optimistically that the global production capacity of 2021 copper mines is about 1.47 million tons. Considering that the epidemic has not yet been completely eliminated, the actual increase is about 800,000 tons with a disturbance rate of 3.5% , + 4.12% year on year, the growth of 2021 is dominated by Indonesia, Peru, Chile, Australia and other countries. 2021-20232023 CAGR growth rate of 2.85% , systematic slowdown according to our statistics, 2021-20232023 copper mine projects are few, new supply is limited, 2021-20232023 copper mine supply is expected to be 92,610,730,000 tons, the annual growth rate of copper mines is expected to be 4.62% , 2.48% and 3.22% . We estimate that CAGR will grow by 2.85% in 2021-2023, which is a systematic slowdown from about 4.8% in 2012-2016, according to the 2023. 2021 ~ 2023: Supply and demand gap to widen gradually outlook 2021 ~ 2023 supply and demand pattern of global copper market, with the arrival of carbon-neutral era, new copper demand space will be opened, global refined copper supply and demand gap will gradually expand. From the supply side, according to our calculation, the global supply of copper in 2023 is 21.49 million tons, 22.02 million tons and 22.73 million tons respectively, which is 4.64% , 2.48% and 3.22% respectively, and CAGR is 2.85% . The global refined copper supply from 2021 to 2021 was 24.6 million tons, 25.16 million tons and 25.88 million tons respectively, representing 4.07% , 2.25% and 2.89% , respectively, and the CAGR was 2.47% , respectively. From the demand side, one is the global clean power plant into the intensive construction period, photovoltaic, wind power, energy storage areas with copper in the ascendant. We expect to add 71-94 GW and 13-26 gw annually, and the average annual copper demand will be 554-669,000 tons in 2023. Overseas power companies are expected to add 103-114 gw of new capacity and 494-579,000 tons of copper in 2023. From 2021 to 2023, the 2023 will carry 5.31,8.22 and 111.20 tonnes of copper, respectively, with CAGR at 44 per cent. Second, the global automobile electrification big time acceleration arrives, the new energy vehicle uses the copper growth kinetic energy is strong. According to our calculation, 4.658 million, 6.659 million and 8.904 million energy vehicles will be sold in 2021-2023, CAGR is up to 38% , and the global copper consumption of new energy vehicles and charging piles in 2021-2023 will be 400,570,770 tons, CAGR is about 39% , respectively. Under the background of clean energy revolution, new demand space of copper will be opened, and the gap between global supply and demand of refined copper will gradually expand. According to our calculation, compared to 2020, the clean energy demand for copper in 2021-2025 will increase by 1.66 million tons, 1.85 million tons, 2.11 million tons, 2.4 million tons and 2.7 million tons, and compared to 2020, the clean energy demand for copper will increase by 4.1 million tons in 2030. In terms of demand contribution, according to our calculation, the new copper demand in the clean energy sector accounted for 6.65% , 7.15% and 7.80% of the global copper consumption in 2021-2021, and the contribution rates of demand growth were 0.97% , 0.85% and 1.08% respectively; The new copper demand for photovoltaic and wind energy storage accounted for 5.04% , 4.93% and 4.95% of the global copper consumption in 2007-08. The contribution rates of demand growth were 0.14% , 0.09% and 0.23% respectively. New Copper demand for new energy vehicles accounted for 1.6% , 2.2% and 2.8% of the global copper consumption in 2007, with the contribution rates of 0.3% , 0.8% and 1% respectively. After 2021, new energy vehicles were the main driving force behind the increase in copper demand. From the balance of supply and demand, considering that the supply of CAGR is 2.85% and that of refined copper is 2.47% in 2021 ~ 2023, which is lower than that of CAGR 4.23% on the demand side, the global refined copper market is short of 304,000 tons, 790,000 tons and 1.18 million tons respectively in 2021 ~ 2023, the projected shortfall in demand is 1.2% , 3% and 4.4% , respectively. Investment Advice: We believe that the global inflation trade has started and that the supply of copper has entered a period of low growth, and that the decline in processing fees has led to a reduction in copper smelting capacity, global refined copper supply and demand gap will gradually expand, copper prices are expected to gain strong momentum.

Source: The big event

Disclaimer: Some pictures and texts on this site are collected from the Internet and are only for learning and communication. The copyright belongs to the original author and does not represent the views of our site. This site will not bear any legal responsibility. If your rights are violated, please contact us to delete it in time.